Pet Store eCommerce - Direct to Consumer

Before the arrival of the COVID-19 virus, our team at Pet Engine Marketing was already looking to modernize and improve the marketing strategy of your standard independent pet retailer. There are thousands of pet retailers across the United States that have successfully been in business for decades - but the pet store marketing and pet retail landscape has changed more in the past five years than it has in the previous 25 years.

Consumer behavior has changed: the where, how, and with whom in particular have undergone drastic shifts. From 2000 to 2020, we have seen traditional powerhouse brands such as Sears, JCPenney, and Toys R’ Us fall victim to the retail apocalypse. They struggled to adapt to changing expectations of their customers, and today newer competitors are better equipped to meet those expectations.

Since the outbreak of the coronavirus, the future has approached the present at an even more rapid pace. Pet stores are, to be frank, scrambling. Online order and pet store eCommerce solutions, once thought of as a project for 2022, have been hurried into deployment. But it’s important to note that this shift was already occurring before the virus came to America - the growth of services like Barkbox, or simple Am*zon, is a testament to this shift. These direct-to-consumer brands (D2C) have gained a lot of market share, providing an eCommerce experience that prioritizes engagement, price point, and ultimately, convenience. This is where pet stores have struggled because they haven’t had to compete quite so hard in these areas. But now, they must.

If this sounds like your pet store, and you know you’ve got to improve, schedule a free consultation and pet store marketing audit with one of our experts.

In this Insider post, we’re going to dig into the direct-to-consumer learnings from those that have already gone through the pain and struggle. As pet stores bring on eCommerce solutions that include dropshipping (sending products straight to a home rather than buy-online-pickup-in-store), it’s a good opportunity to realize that you don’t have to reinvent the wheel. Learn from those that are doing it best and apply what works to make gains.

Pet Store eCommerce

Direct to Consumer

81% of consumers say they'll make at least one purchase from a D2C brand within the next five years (Source: RetailDive). This is a huge opportunity and indicator for pet store owners to improve their pet store’s marketing strategy. If you’ve already got the tools, logistics, and platforms set up, then it’s just a question of using your marketing assets to capture marketing share. If you haven’t got those setup, then give us a call, or take advantage of our free community focusing on marketing help for pet businesses.

Here are a few lessons pet store owners can learn from the innovative new members of the D2C industry on convenience, price, and engagement. Of course, we’ll have data to back it all up.

Convenience

The sad truth is that, more than ever, shoppers won’t interact with a new retailer if it’s not convenient to do so. Some pet retailers are lucky to have a loyal, long-standing customer base. But that’s not all you need to grow your pet store - you do need to bring in new business and new customers.

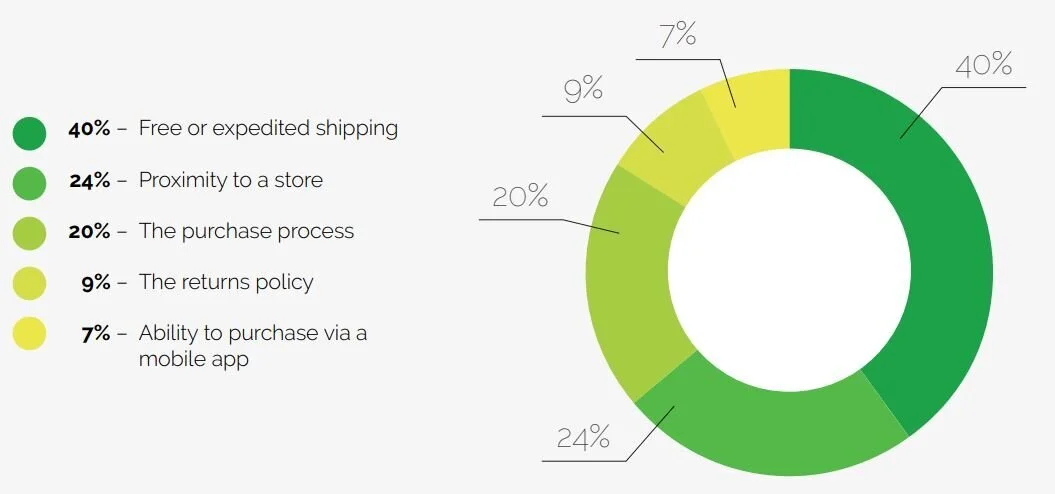

One in five consumers rank convenience of the purchase process as the most significant factor when considering a purchase from a new retailer, and 40% ranked free or expedited shipping as the most significant factor, according to a study done by Yes Marketing.

D2C success stories have embraced e-commerce messaging strategies that emphasize convenience as much as they do price and quality. The key to this is being rather like a broken record, repeating the values and benefits at the first, middling, and final consumer touchpoints. Throughout the consumer journey, convenience remains at the forefront of the marketing messaging.

To apply this to your pet store, you can consider baking shipping fees into the price to offer free shipping - or you can just cover the shipping because you’re not paying to purchase the product in the first place. Offering a generous return policy is convenient and screams “we’re easy to work with!” A final idea: incentivizing BOPIS (buy online pickup in-store) with an expedited checkout process is a great way to improve the convenience of your pet store’s offers and to increase customer loyalty.

price

As most pet retailers know, this is a line that has to be toed carefully. It can be exceedingly tough to balance your expenses, budgets, and product markup while trying to compete and beat eCommerce platforms and big-box retailers. According to the same study by Yes Marketing, 47% of consumers ranked price as the highest among product-related features that influence their purchasing decisions.

Discounts and loss-leaders always help brands and businesses attract new consumers. But lowering prices isn’t a long-term solution for retailers and these strategies demand that you proceed with caution. Too many sales and you destroy your profit margins, your customers expect it continuously, and it can even devalue the quality of your pet store’s products.

Instead, consider emphasizing the value customers receive from their products or the purchasing experience (in-store or out-of-store) so they feel justified in their purchasing decision, even when items aren’t on discount. A little-known sales trick that works like a charm: maintain your price for your top-selling and highest-margin items, but heavily discount the accessories that improve the experience of those products. This will increase the perceived value-to-price equation without devaluing your best products, or tarnishing the bottom line.

Engagement

As a pet store owner, you have the deepest understanding of the customers that come into your store. You know that there are several “classes” of customers:

Class A: They shop at your pet store for everything, engage online, open emails, and advocate for your brand to their friends. They are your best customers.

Class B: They shop at your pet store occasionally, maybe once or twice every few months. They like you, and you’re there when they need you, but they aren’t fully plugged into your brand.

Class C: The one-offs. They buy something, don’t create a loyalty account, and you may never see them again. They do most of their shopping elsewhere.

Customer acquisition is critical to continue to bring new revenue into your business, but in order to build those Class C customers into Class A customers, they need to be properly engaged before, during, and after that first purchase.

Successful D2C companies have refreshed their approach to email marketing, providing value beyond discounts and abandoned cart reminders (these are still effective, though!). Email campaigns work best when they are relevant and engaging: emails should be targeted and segmented based on consumer behavior and preferences. In other words, don’t send cat products to dog owners. Providing additional resources (long-form pet store SEO blog articles, infographics, cute content, or how-to’s) provide added value and can improve your pet store’s credibility and standing in the consumer’s mind.

Since customers are now expecting more relevant communications, you’ll need to use a diverse range of data sources to collect information and meet the revised consumer expectations.

Pet Store eCommerce

Direct to Consumer

Conclusion

D2C, as an industry, began as a crazy idea and blossomed into a revolution threatening to overturn the traditional retail industry through a dominant strategic marketing mix focusing on convenience, price, and engagement. As a result of COVID-19, all pet stores are being forced to adapt and relearn some of the traditional ways of doing things. In the era of quick commerce, it’s critical to know which values consumers rank most highly in order to continue to drive customer acquisition, build brand loyalty, and deliver value.

What are you doing that’s working? Which values are you striving to proclaim as you shift gears? Share your feedback with us and other community members in our Facebook group: Marketing Help for Pet Businesses.